Introduction: Making Every Dollar Count in Crypto

Starting your cryptocurrency journey with $1,000 is like standing at the edge of a vast digital frontier. It’s enough capital to build a meaningful portfolio, but not so much that mistakes will be financially devastating. This “goldilocks” amount gives you the perfect opportunity to learn portfolio management while experiencing real market dynamics.

While $1,000 might seem modest compared to headlines about crypto millionaires, it’s actually an ideal starting point for most retail investors. With this amount, you can achieve meaningful diversification across different cryptocurrencies and investment strategies without overextending yourself financially.

According to a 2024 survey by Gemini, nearly 68% of new crypto investors start with less than $1,000. What separates successful investors from the rest isn’t their starting capital, but rather how strategically they allocate those initial funds.

In this comprehensive guide, we’ll walk through exactly how to build a diversified $1,000 crypto portfolio that balances reasonable risk with growth potential. You’ll learn proven allocation strategies, discover which assets deserve consideration, understand timing techniques that maximize your investment, and develop a sustainable approach to managing your crypto investments for the long term.

If you’re new to the cryptocurrency space, our cryptocurrency beginner’s guide explains the essential concepts you’ll need to understand before investing.

The Foundation: Understanding Risk Management in Crypto

Before discussing specific cryptocurrencies, we need to establish the fundamental principle that will protect your investment: proper risk management.

Cryptocurrency remains a highly volatile asset class. Even “blue-chip” cryptocurrencies like Bitcoin can experience daily price swings of 5-10%, while smaller altcoins may move 20% or more in a single day. This volatility creates both opportunity and danger.

The key to successful crypto investing isn’t eliminating risk (that’s impossible), but rather managing it effectively through diversification and position sizing.

Risk Management Principles for Your $1,000 Portfolio

- Portfolio Allocation: Never put all your money into a single cryptocurrency, no matter how promising it seems. Spread your investment across multiple assets with different risk profiles.

- Position Sizing: Allocate larger portions of your portfolio to established cryptocurrencies with proven track records, and smaller amounts to more speculative investments.

- Risk Tolerance Assessment: Be honest about how much volatility you can psychologically handle. If price swings keep you up at night, adjust your portfolio toward more conservative allocations.

- Correlation Awareness: Select cryptocurrencies that don’t all move in perfect unison. This helps ensure that a single market event doesn’t devastate your entire portfolio.

- Capital Preservation: Consider keeping a small portion (5-10%) in stablecoins to capitalize on buying opportunities during market downturns.

Remember that your $1,000 investment should be money you can afford to lose. While we’re building a strategy designed for growth, cryptocurrency remains a high-risk investment class where significant downside is always possible.

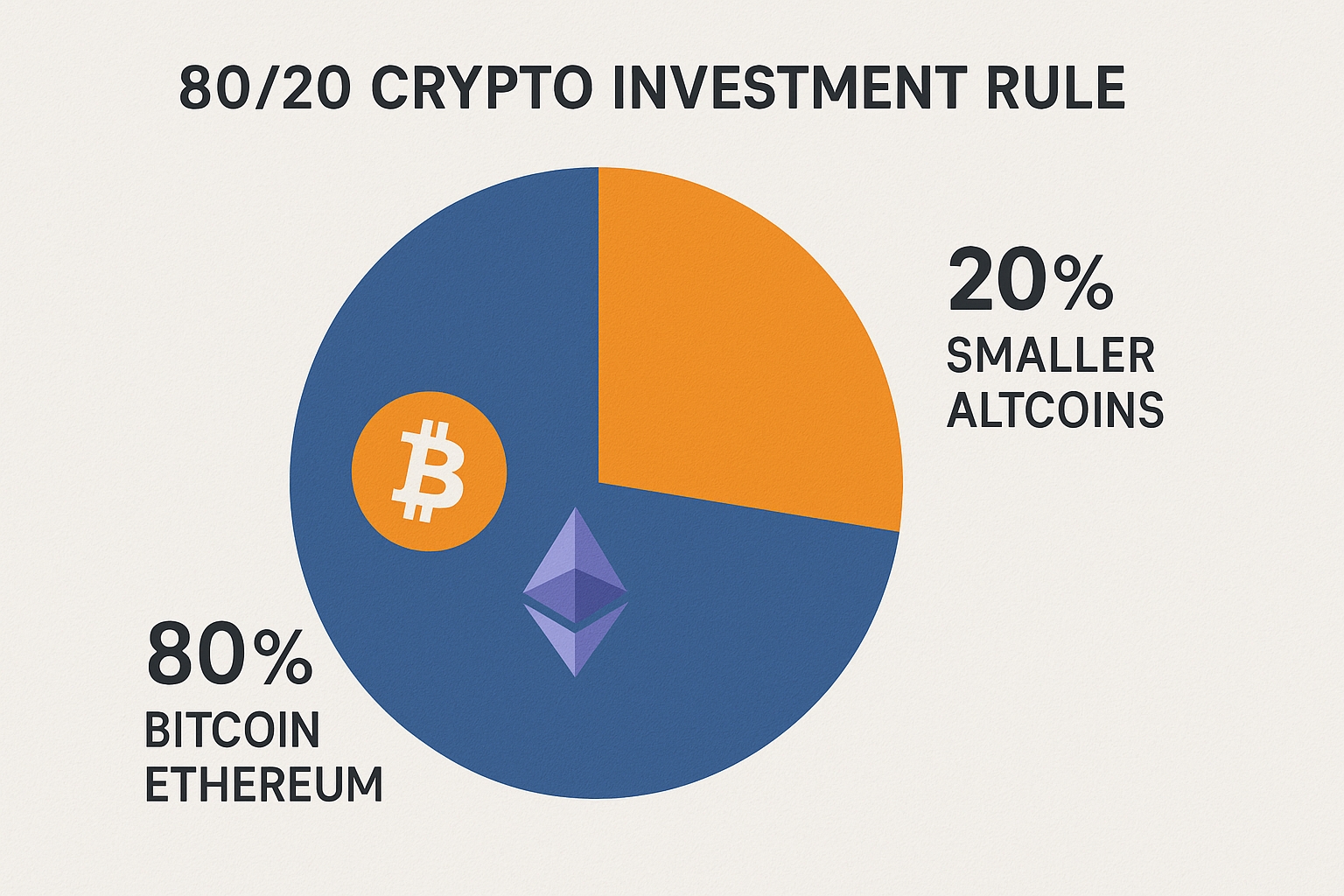

The 80/20 Approach: A Framework for Your First $1,000

One of the most effective strategies for beginners is the 80/20 rule of crypto investing: allocate 80% of your funds to established, larger cryptocurrencies and 20% to smaller, more speculative projects.

This approach provides exposure to the proven track record of market leaders while still allowing participation in potential high-growth opportunities. For a $1,000 portfolio, this would mean:

- $800 in established cryptocurrencies (Bitcoin, Ethereum, and perhaps 1-2 other top 10 assets)

- $200 in smaller altcoins with higher risk/reward profiles

The Established Core (80% – $800)

The foundation of your portfolio should consist of cryptocurrencies with:

- Significant market capitalization

- Established history (at least 3+ years in existence)

- Strong developer communities

- Clear use cases and adoption

- Substantial liquidity

Based on these criteria, the following allocation represents a balanced approach for the 80% core of your portfolio:

Bitcoin (BTC): 45% – $450

As the first cryptocurrency and the largest by market capitalization, Bitcoin deserves the largest allocation in most portfolios. With over a decade of history, Bitcoin has demonstrated remarkable resilience through multiple market cycles.

Bitcoin serves as a store of value, hedging against inflation and financial instability. Its fixed supply of 21 million coins creates inherent scarcity, while its widespread adoption continues to grow among both retail and institutional investors.

Why It Belongs in Your Portfolio: Bitcoin has consistently outperformed traditional asset classes over the long term and has emerged as “digital gold” with institutional acceptance.

Ethereum (ETH): 25% – $250

As the second-largest cryptocurrency, Ethereum powers thousands of decentralized applications (dApps) and has revolutionized finance through its smart contract capabilities. Ethereum’s platform hosts everything from decentralized finance (DeFi) protocols to non-fungible tokens (NFTs) and gaming applications.

The transition to Ethereum 2.0 has enhanced scalability and energy efficiency through proof-of-stake consensus, while allowing staking rewards for holders.

Why It Belongs in Your Portfolio: Ethereum has practical utility beyond being a store of value and continues to lead innovation in blockchain technology.

Large-Cap Altcoin: 10% – $100

Allocating a smaller portion to one additional large-cap cryptocurrency provides additional diversification. Depending on your research and interest, consider one of these established options:

- Solana (SOL): High-performance blockchain with fast transaction speeds and growing ecosystem

- Cardano (ADA): Research-driven approach to blockchain development with focus on sustainability

- Binance Coin (BNB): Utility token of the largest cryptocurrency exchange with multiple use cases

- Polkadot (DOT): Interoperable blockchain connecting various specialized blockchains

Selection Criteria: Focus on cryptocurrencies within the top 15 by market capitalization that offer something technologically distinct from Bitcoin and Ethereum.

The Growth Opportunity (20% – $200)

The remaining 20% of your portfolio provides exposure to higher-risk, higher-reward opportunities. This portion can be divided among 2-4 smaller projects that show promising technology, unique value propositions, and growth potential.

When selecting these investments, prioritize:

- Strong development teams with verifiable backgrounds

- Clear roadmaps with measurable milestones

- Active community engagement

- Unique technological advantages

- Actual utility rather than pure speculation

This segment of your portfolio will likely experience the most volatility, but also offers the greatest potential upside. You might consider allocating:

- Mid-Cap Altcoin #1: 10% – $100 (e.g., a Layer 2 scaling solution or DeFi protocol)

- Mid-Cap Altcoin #2: 5% – $50 (e.g., a privacy-focused cryptocurrency)

- Small-Cap Altcoin: 5% – $50 (e.g., an emerging technology with unique solutions)

Important Note: The specific altcoins in this category require thorough research and will change over time as technologies and projects evolve. What’s promising today may not be tomorrow, making this the most actively managed portion of your portfolio.

Building Your Portfolio: Practical Implementation Strategies

Once you’ve determined your allocation strategy, the next step is implementing it effectively. Here are practical approaches to building your $1,000 portfolio:

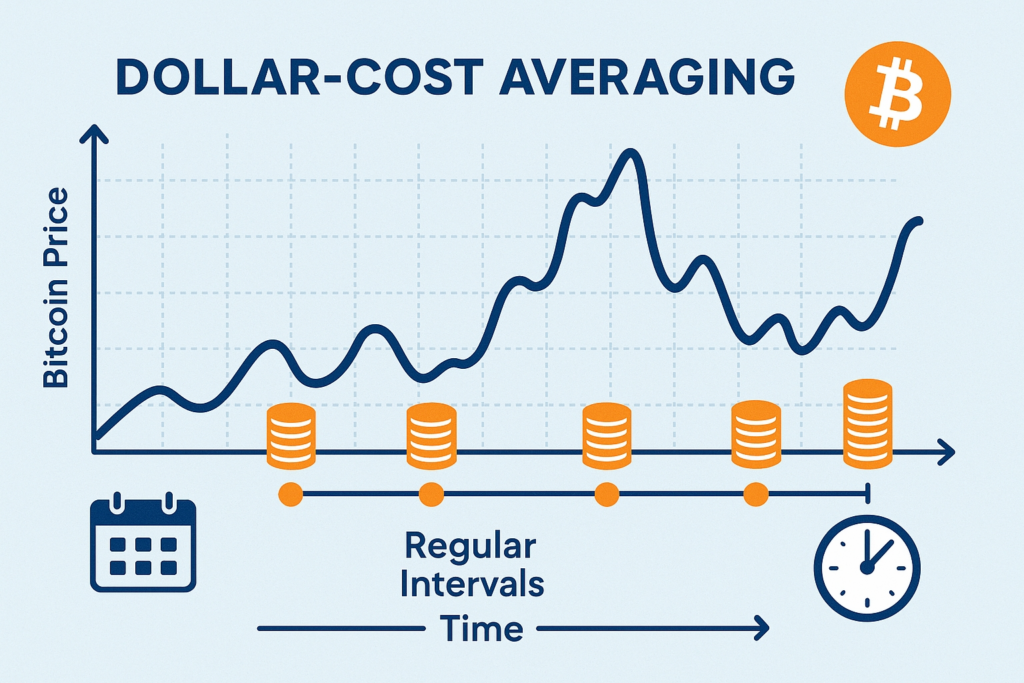

Lump Sum vs. Dollar-Cost Averaging

You have two primary options for deploying your $1,000:

- Lump Sum Investing: Investing the entire $1,000 at once according to your chosen allocations.

- Pros: Fully invested from day one; historically outperforms DCA during bull markets

- Cons: Higher exposure to short-term volatility; potential for buying at temporary market peaks

- Dollar-Cost Averaging (DCA): Spreading your investment over time, such as $250 per week for four weeks.

- Pros: Reduces impact of volatility; psychologically easier; averages your purchase price

- Cons: May miss substantial gains if the market rises consistently; requires more transactions

For most beginners, a hybrid approach works well:

- Invest 50% ($500) immediately according to your allocation plan

- Deploy the remaining 50% over 2-4 weeks using dollar-cost averaging

This balances the benefits of both methods while providing time to become comfortable with the market’s volatility.

Exchange Selection and Security

Selecting the right cryptocurrency exchange is crucial for both security and usability. For a $1,000 portfolio, consider these factors:

- Security: Prioritize exchanges with strong security records, insurance policies, and cold storage for most assets.

- Fee Structure: Look for competitive trading fees (under 0.5% per transaction) and reasonable withdrawal fees.

- Asset Selection: Ensure the exchange offers all the cryptocurrencies in your planned portfolio.

- User Experience: Especially for beginners, an intuitive interface with educational resources is valuable.

- Regulatory Compliance: Choose exchanges that comply with regulations in your jurisdiction.

Recommended beginner-friendly exchanges include:

- Coinbase/Coinbase Pro (now Advanced Trade)

- Gemini

- Kraken

- Binance/Binance.US

Security Best Practices:

- Enable two-factor authentication (2FA) using an authenticator app (not SMS)

- Use a unique, strong password for your exchange account

- Consider a hardware wallet once your portfolio exceeds $3,000 in value

- Never share private keys or seed phrases with anyone

For a detailed comparison of platforms, check our guide to the best cryptocurrency exchanges for beginners to find the right fit for your trading style and security preferences.

Tax Considerations

Cryptocurrency investments have tax implications that should be understood from the beginning:

- Most jurisdictions treat cryptocurrencies as property, making transactions potentially taxable events

- Trading between cryptocurrencies typically triggers capital gains/losses

- Holding assets for more than one year before selling may qualify for lower long-term capital gains rates

- Consider using crypto tax software to track your transactions from day one

- Keep records of all purchases, sales, and transfers

While $1,000 may seem small, establishing good record-keeping habits now will save tremendous headaches later as your portfolio grows.

Understanding the implications is crucial – our comprehensive cryptocurrency tax guide explains how different transactions are treated and the best practices for staying compliant.

Advanced Diversification Strategies

As you become more comfortable with cryptocurrency investing, you can explore additional diversification strategies to enhance your portfolio:

Diversification by Use Case

Beyond just market capitalization, consider diversifying across different cryptocurrency use cases:

- Store of Value: Bitcoin and similar cryptocurrencies focused on preserving wealth

- Smart Contract Platforms: Ethereum, Solana, Cardano, and others enabling decentralized applications

- Payment Networks: Cryptocurrencies optimized for faster, cheaper transactions

- Decentralized Finance (DeFi): Protocols enabling lending, borrowing, and trading without intermediaries

- Web3 Infrastructure: Projects building the foundation for the decentralized internet

- Privacy Coins: Cryptocurrencies with enhanced anonymity features

- Interoperability Solutions: Projects focusing on connecting different blockchains

Allocating across these categories ensures you’re exposed to multiple aspects of blockchain innovation, rather than concentrating in just one area.

Staking and Yield Opportunities

Many cryptocurrencies offer staking rewards or yield opportunities, allowing you to earn passive income on your holdings. Consider allocating a portion of your portfolio to assets that offer:

- Proof-of-Stake Rewards: Earn additional tokens by participating in blockchain validation

- Lending Yields: Generate interest by lending your assets through reputable platforms

- Liquidity Provision: Earn fees by providing liquidity to decentralized exchanges

These strategies can significantly enhance your returns over time, but always thoroughly research the risks involved, particularly with higher-yielding opportunities.

Rebalancing Your Portfolio

As prices change, your carefully planned allocation percentages will drift. For example, if Bitcoin doubles while your altcoins remain flat, your Bitcoin allocation will become a much larger percentage of your portfolio than originally intended.

Rebalancing involves periodically adjusting your holdings to maintain your target allocations:

- Frequency: Consider rebalancing quarterly or when allocations drift more than 20% from targets

- Tax Efficiency: Be mindful of the tax implications of rebalancing transactions

- Transaction Costs: Factor in fees when deciding whether minor rebalancing is worthwhile

For a $1,000 portfolio, the impact of small allocation drifts is minimal, so rebalancing once every 3-6 months is usually sufficient.

Managing Psychology: The Biggest Challenge

Perhaps the greatest challenge in cryptocurrency investing isn’t selecting the right assets but managing your own psychology. The extreme volatility can trigger emotional responses that lead to poor decision-making.

Common Psychological Pitfalls

- FOMO (Fear of Missing Out): Chasing cryptocurrencies after significant price increases, buying at local tops

- Panic Selling: Selling during market downturns, locking in losses rather than holding through volatility

- Overconfidence: Allocating too much to speculative investments after experiencing initial success

- Analysis Paralysis: Becoming overwhelmed with information and unable to make investment decisions

- Checking Prices Compulsively: Creating unnecessary stress and increasing likelihood of emotional trades

Psychological Management Strategies

- Set Clear Rules: Establish specific criteria for buying, selling, and rebalancing before you invest

- Limit Checking Prices: Schedule specific times to review your portfolio (weekly or monthly) rather than checking constantly

- Journal Your Decisions: Document your investment rationale to review later and improve decision-making

- Focus on Fundamentals: Evaluate projects based on development activity and adoption, not price action alone

- Embrace Volatility: Understand that significant price swings are normal in crypto and don’t necessarily indicate fundamental problems

Remember that building wealth through cryptocurrency is a marathon, not a sprint. The investors who succeed over the long term are those who can maintain emotional discipline through market cycles.

Sample $1,000 Portfolio Allocations

To provide concrete examples, here are three sample $1,000 portfolio allocations for different investor profiles:

Conservative Approach

For investors who prioritize capital preservation with moderate growth potential:

- Bitcoin (BTC): 60% – $600

- Ethereum (ETH): 25% – $250

- Top 10 Altcoin: 10% – $100

- Stablecoin (USDC): 5% – $50

Key Features: Heaviest Bitcoin allocation; includes stablecoin reserve for buying opportunities; limited altcoin exposure.

Balanced Approach

For investors seeking a middle ground between safety and growth:

- Bitcoin (BTC): 45% – $450

- Ethereum (ETH): 25% – $250

- Large-Cap Altcoin (e.g., Solana): 10% – $100

- Mid-Cap Altcoins (2): 15% – $150

- Small-Cap Altcoin: 5% – $50

Key Features: Core BTC/ETH position; diversified altcoin exposure; balanced between established and emerging assets.

Growth-Oriented Approach

For investors with higher risk tolerance seeking maximum growth potential:

- Bitcoin (BTC): 30% – $300

- Ethereum (ETH): 30% – $300

- Large-Cap Altcoins (2): 20% – $200

- Mid-Cap Altcoins (2): 15% – $150

- Small-Cap Altcoin: 5% – $50

Key Features: Equal BTC/ETH weighting; higher allocation to altcoins; more diversified across market caps.

Real-World Success Stories

While individual results always vary, these anonymized examples illustrate different approaches to building a $1,000 portfolio:

Case Study 1: The Patient Accumulator

Rachel began with $1,000 in 2022, allocating 60% to Bitcoin, 30% to Ethereum, and 10% to Polkadot. Instead of constantly trading, she committed to adding $100 monthly to her portfolio regardless of market conditions, maintaining the same allocation percentages.

By consistently investing through the bear market of 2022 and the subsequent recovery, her portfolio had grown to approximately $4,800 by early 2025 – not just from price appreciation but from the power of consistent contributions. Her disciplined approach and emotional resilience during market downturns were key to her success.

Key Lesson: Consistent investing over time can be more important than perfectly timing the market.

Case Study 2: The Research-Driven Investor

Michael invested $1,000 across seven carefully researched cryptocurrencies in 2023, including Bitcoin, Ethereum, and several smaller projects with strong fundamentals. He spent 3-5 hours weekly studying blockchain technology, project developments, and market trends.

This research led him to rebalance his portfolio quarterly, gradually increasing allocation to projects showing real-world adoption while reducing exposure to those failing to deliver on roadmaps. By March 2025, his portfolio had grown to approximately $3,200, outperforming what would have been achieved with a static Bitcoin-only approach.

Key Lesson: Informed research and strategic rebalancing can enhance returns beyond passive holding.

Frequently Asked Questions

Is $1,000 enough to start investing in cryptocurrency?

Yes, $1,000 is an excellent starting amount for cryptocurrency investing. It allows meaningful diversification across several assets while keeping risk at a manageable level for most investors. Many successful crypto investors began with similar or smaller amounts.

Should I just put all $1,000 into Bitcoin?

While Bitcoin has historically been the best-performing cryptocurrency over the long term, allocating your entire investment to a single asset eliminates the benefits of diversification. A Bitcoin-heavy portfolio with some allocation to other cryptocurrencies provides better risk-adjusted potential returns for most investors.

How often should I check my portfolio?

For a long-term investment approach, checking weekly or even monthly is sufficient. Constant monitoring increases the likelihood of making emotional decisions based on short-term price movements. Set price alerts for significant movements if you’re concerned about missing important market events.

When should I take profits?

Consider taking partial profits when:

- An individual position grows to more than twice its target allocation percentage

- You’ve reached specific price targets established before investing

- Your overall crypto allocation exceeds your predetermined limit within your total investment portfolio

Rather than attempting to time market tops perfectly, many successful investors gradually take partial profits during significant uptrends.

What if I make a mistake in my initial selections?

Mistakes are part of the learning process in cryptocurrency investing. If you realize you’ve invested in a project with fundamental flaws, it’s often better to admit the mistake and reallocate those funds rather than hoping for a recovery. However, distinguish between normal market volatility and actual project failures before making changes.

Conclusion: Your Journey Begins With the First $1,000

Building a diversified $1,000 cryptocurrency portfolio is just the beginning of your investment journey. While the specific allocations and cryptocurrencies mentioned in this guide provide a solid starting point, the most successful investors continuously learn, adapt, and refine their approach as the market evolves.

Remember these core principles as you move forward:

- Start with proper research before investing a single dollar

- Diversify across multiple cryptocurrencies to manage risk

- Invest consistently over time rather than trying to time the market

- Maintain emotional discipline during market volatility

- Stay informed but avoid information overload

- Focus on the long-term potential of blockchain technology

With discipline, patience, and continuous learning, your initial $1,000 investment can grow substantially over time, potentially becoming a significant part of your overall financial portfolio.

What are your thoughts on building a diversified crypto portfolio? Have you had success with particular allocation strategies? Share your experiences in the comments below to help other readers on their investment journey.